billings montana sales tax rate

The median property tax in Montana is 146500 per year for a home worth the median value of 17630000. The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible.

How Is It To Live In The Western States Of The Usa Like Idaho Utah Or Montana Quora

Home is a 4 bed 40 bath property.

. Rates include state county and city taxes. Counties in Montana collect an average of 083 of a propertys assesed fair market value as property tax per year. Income and Salaries for Billings - The average income of a Billings resident is 28364 a year.

- Tax Rates can have a big impact when Comparing Cost of Living. This means that the state does not collect any sort of sales tax at the state or local level. According to the since-removed notice the royalty rate at the upcoming lease sale would be 1875 a substantial deviation from the 125 rate used by the BLM for more than a century.

Sales tax region name. 4 rows The current total local sales tax rate in Billings MT is 0000. 0 State Sales tax is -----NA-----.

Montana is ranked number twenty nine out of the fifty states in order of the average amount of property taxes collected. Boosted money for a federal conservation program to a record level in 2022 officials announced. The latest sales tax rates for cities in Montana MT state.

Fees collected at the time of permanent registration are. Did South Dakota v. While many other states allow counties and other localities to collect a local option sales tax Montana does not permit local sales taxes to be collected.

Billings MT currently has 94 tax liens available as of February 10. The County sales tax rate is. The Billings Montana sales tax is NA the same as the Montana state sales tax.

The Billings sales tax rate is. Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated.

Montana Individual Income Tax Resources. AP Tax receipts from surging gun and ammunition sales in the US. 59107 zip code sales tax and use tax rate Billings Yellowstone County Montana.

The US average is 46. Theyve called for cutting the tax from 635 to 599 and eliminating the additional 1 meals tax from February 15 through the end of calendar year 2022. Sales Tax in Billings Montana Fortunately residents of Montana enjoy no sales tax.

The US average is 73. The December 2020 total. County tax 9 optional state parks support certain special plate fees and for light trucks the gross vehicle weight GVW fees.

The Billings Sales Tax is collected by the merchant on all qualifying sales made within Billings. Has impacted many state nexus laws and sales tax collection requirements. Montana has no state sales tax and allows local governments to collect a local option sales.

BOISE Idaho AP A proposal put forward Tuesday would increase by 20 the amount of money Idaho residents can recover on taxes paid on food through a grocery sales tax credit. Republicans on the Senate State Affairs committee agreed. Wayfair Inc affect Montana.

It would have cut the 45 sales tax to 4 over the next two years representing an estimated 150 million in annual revenue for the state. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Billings MT at tax lien auctions or online distressed asset sales. View more property details sales history and Zestimate data on Zillow.

The Billings sales tax rate is NA. 2020 rates included for use while preparing your income tax deduction. Montanas progressive state income tax system has a top rate of 69 property taxes are below the national average and there is no state sales tax.

Tax Rates for Billings - The Sales Tax Rate for Billings is 00. Sales Tax and Use Tax Rate of Zip Code 59107 is located in Billings City Yellowstone County Montana State. Tax Liens List For Properties In And Near Billings MT How do I check for Tax Liens and how do I buy Tax Liens in Billings MT.

Tax rates last updated in February 2022. 10 Montana Highway Patrol Salary and Retention Fee. 1605 Forest Park Dr Billings MT 59102-7921 is a single-family home listed for-sale at 899900.

- The Income Tax Rate for Billings is 69. The Montana sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v.

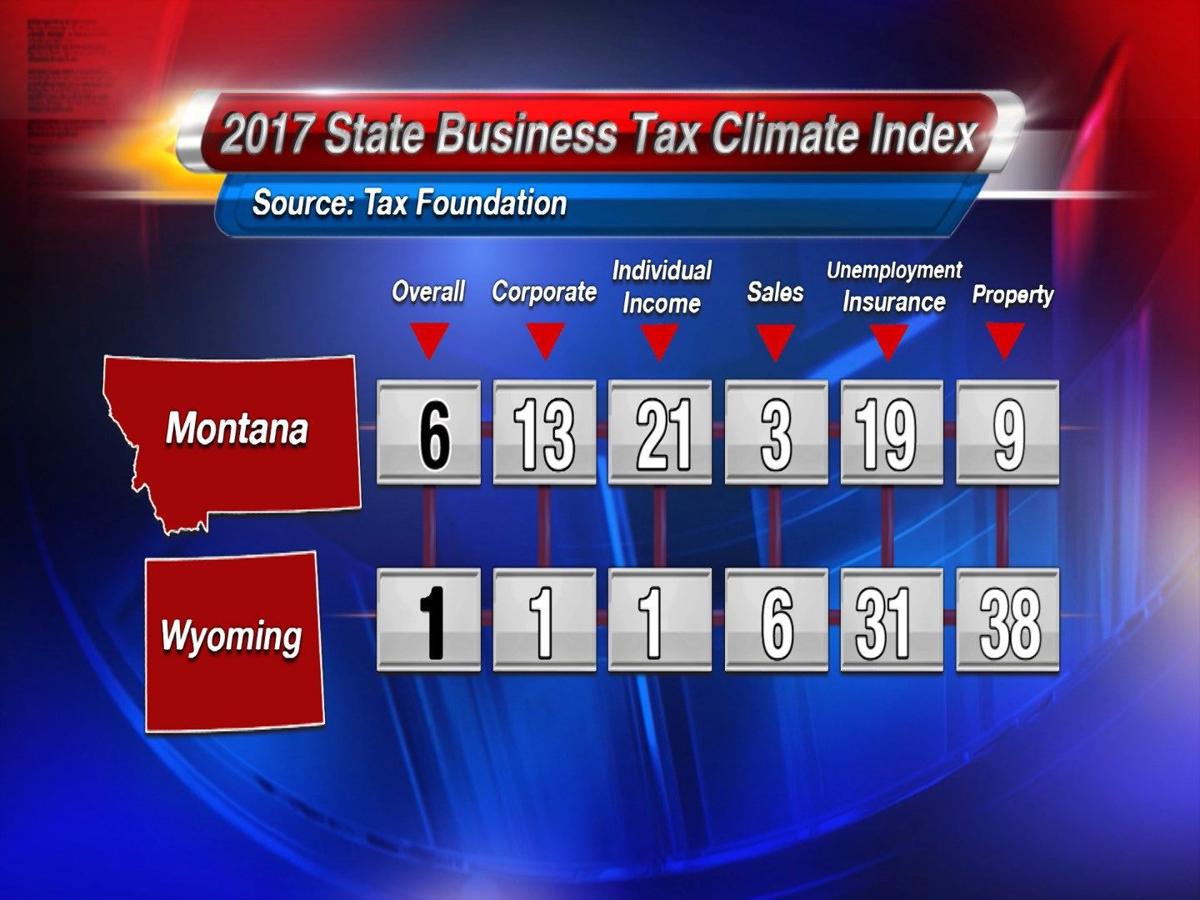

Montana And Wyoming Rank In Top 10 For Taxes News Kulr8 Com

District Of Columbia Sales Tax Small Business Guide Truic

Annual Income Tax Filling Free Ads Classified Income Tax Return Income Tax Income Tax Return Filing

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate

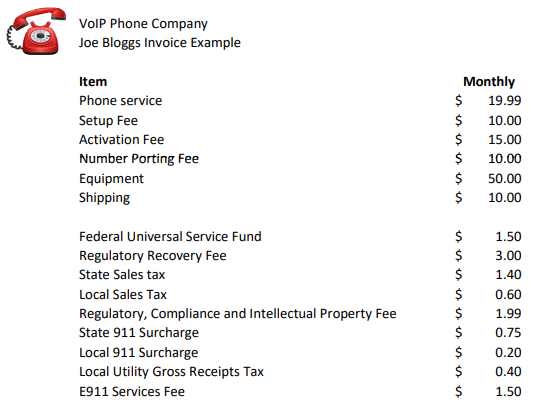

Voip Pricing Taxes And Regulatory Fees Explained

Ron Drzewucki S Bullion Sales Tax Series State By State Pt 3

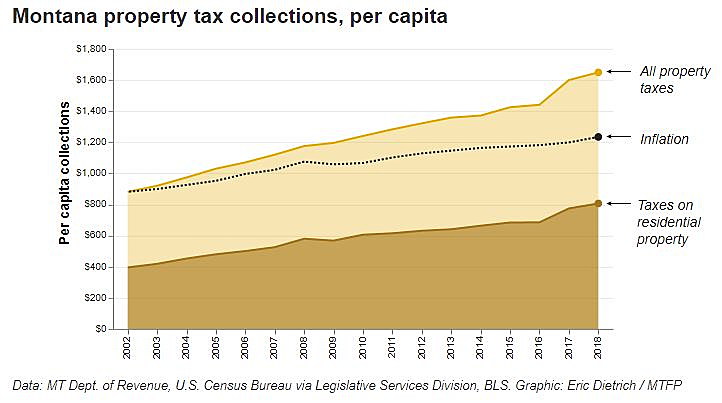

Montana Property Taxes Montana Property Tax Example Calculations

Montana Sales Tax Rates By City County 2022

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Wyo Property Tax Rates Rank Right At The Bottom Wyoming News Trib Com

How High Are Cell Phone Taxes In Your State Tax Foundation

Missoulian Editorial In Mt Much To Appreciate On Tax Day Editorial Missoulian Com

Missouri Sales Tax Rates By City County 2022

Billings Oklahoma S Sales Tax Rate Is 6

Montana State Taxes Tax Types In Montana Income Property Corporate

New York Sales Tax Rates By City County 2022

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax Goods And Services State Tax